Navigating Oversupply, Rising Costs, and Emerging Opportunities

New Zealand’s housing market is entering a transitional phase in 2025. Following a decade of growth, accelerated by post-Covid stimulus and rapid urban intensification, the sector now faces a more complex set of conditions. Elevated housing supply, rising development contributions, migration shifts, and infrastructure delays are reshaping the landscape. Yet, with interest rates easing and investor-friendly tax settings returning, the medium-term outlook offers plenty of scope for strategic decision-making. For property developers, investors, and mortgage brokers, understanding where the risks lie—and where the potential gains remain—is crucial in this recalibrating environment.

Auckland’s Market: Oversupply Now, Opportunity Later

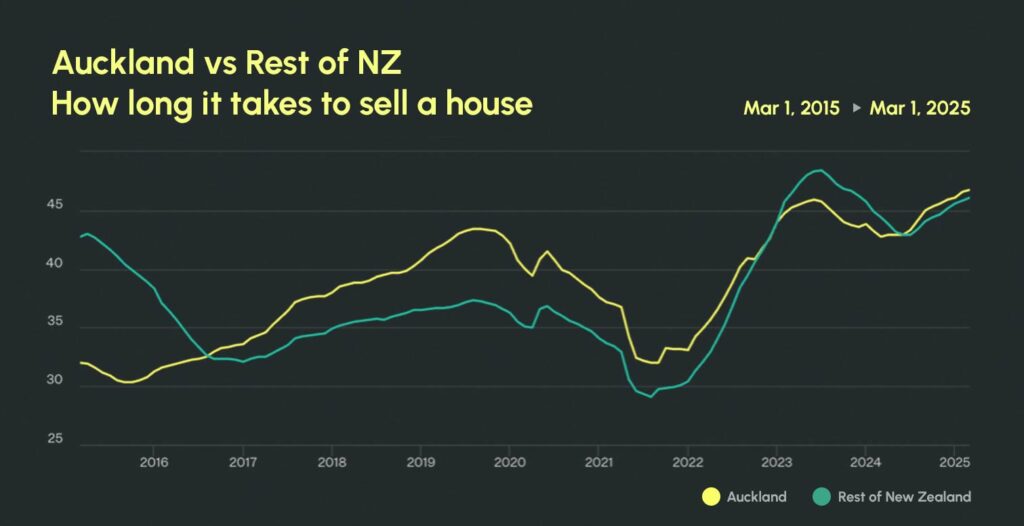

Auckland is currently experiencing its highest number of unsold residential properties in recent memory, with over 6,200 listings as of early 2025. This oversupply is not just a result of recent overbuilding but also reflects a more cautious buyer pool. The Unitary Plan successfully delivered higher-density development across the city, creating long-term value in areas previously under-utilised. However, recent market softness has highlighted the need for better alignment between supply and demand. Developers who are nimble—scaling back or rephasing projects—may be better positioned to weather current conditions and be ready when buyer demand rebounds. For mortgage brokers, the current pause presents a valuable moment to help clients reassess financing options and prepare for improved affordability.

Monetary Tightening Eases, but Leaves a Lingering Impact

The sharp rise in interest rates between 2023 and 2024 had a clear cooling effect on the housing sector. For developers, it constrained finance availability and forced re-evaluation of project feasibility. For investors, the cost of capital increased while yields came under pressure. The pace of activity slowed across the board. With the RBNZ signalling a more neutral policy stance, the door is opening to renewed development activity and investment interest. Developers with a strong capital base, and investors with long-term horizons, will likely see renewed opportunities as financing becomes more accessible.

Development Contributions: Rising Costs Demand Creative Responses

The proposed increases to Auckland Council’s development contributions represent a significant shift in the cost base for new projects. In some areas, fees may more than double. While the council argues this reflects real infrastructure needs and supports urban growth, developers are understandably concerned about the impact on project viability. Some projects may need to be redesigned or postponed, while others—particularly in higher-value locations—may still be feasible with adjusted pricing. For investors, this could mean fewer new completions in the short term, which may support prices and rents for existing stock.

Infrastructure Delays: Still a Drag on Delivery

Delays in water and wastewater approvals, continue to hold back progress in key Auckland growth areas. These delays increase holding costs and extend timelines—an issue for both developers and pre-sale buyers.While some improvements are underway, the pace of infrastructure coordination still lags demand. For developers, close collaboration with service providers and local authorities is now essential. Flexibility in project staging or contingency financing may be necessary to manage extended delivery windows. For mortgage brokers, clear communication with clients about delivery risks and realistic timeframes will help build trust and reduce surprises.

Migration: Short-Term Slowdown, Long-Term Potential

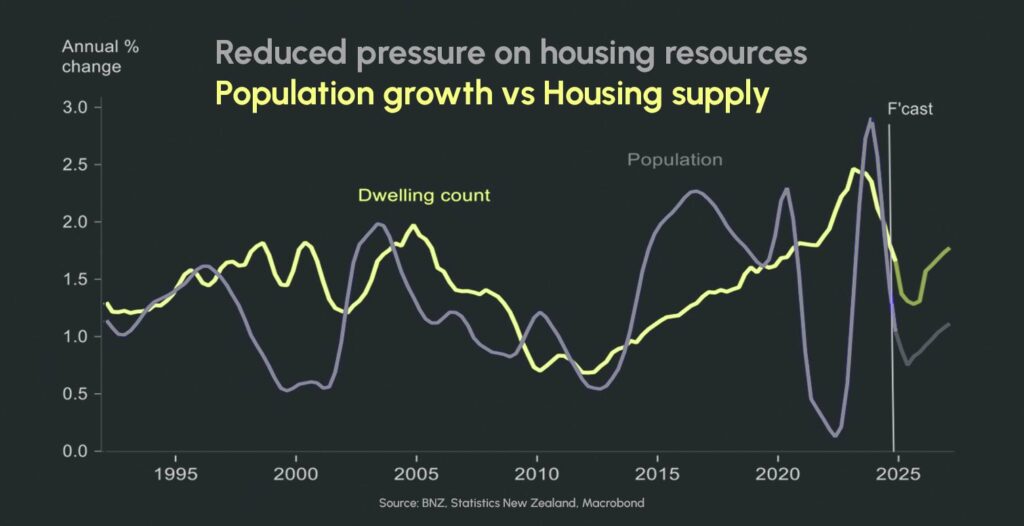

Migration surged in 2023, then moderated significantly through 2024. This cooling has dampened short-term housing and rental demand, particularly in urban areas popular with new arrivals. However, the longer-term outlook remains constructive, with government settings expected to favour skilled migration and population growth over the coming years. Developers planning multi-phase or longer-horizon projects should continue to factor in these macro trends, targeting areas aligned with employment growth and transport infrastructure. Investors may want to focus on well-connected suburbs where rental demand is expected to recover as migration picks up. Brokers should be advising clients with a view to 3–5-year horizons, rather than relying on near-term activity levels alone.

Tax Changes Support Investor Confidence

A positive shift for the investment community is the return of full interest deductibility on residential investment properties, effective April 1, 2025. This policy reversal is expected to increase after-tax returns and may help reignite interest in the buy-and-hold segment. While it may not immediately offset weaker yields in a softer rental market, it does provide greater financial certainty and strengthens the case for longer-term residential investment. Mortgage brokers and financial advisers can use this policy change to re-engage clients who may have paused investment plans in recent years.

Conclusion: Strategy, Timing, and Adaptability Will Define Success

The 2025 housing market presents a mixed picture: oversupply, rising input costs, and infrastructure delays on one hand, but easing interest rates, supportive tax policy, and solid long-term fundamentals on the other. For developers, this is a time to reassess project pipelines, explore partnerships, and prioritise locations with clear demand signals. For investors, the return of favourable tax treatment and stabilising rates create a more predictable environment. And for mortgage brokers, there’s a clear opportunity to add value through smarter lending strategies and personalised advice.